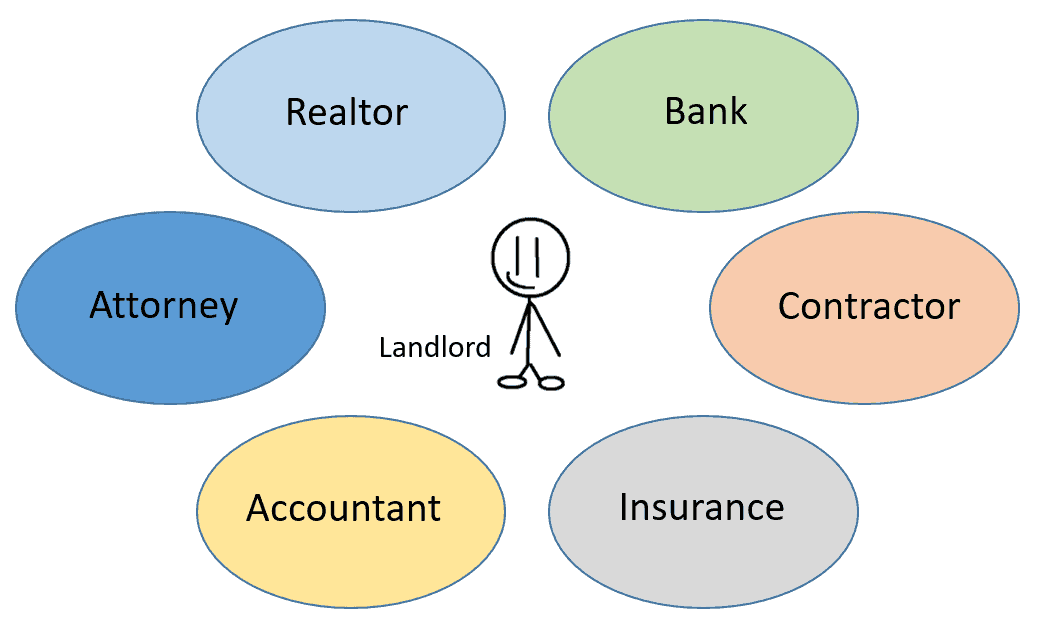

Over the past handful of years, I have narrowed down 6 critical areas where you must have trusted relationships in order to be successful. If you don’t have all of these critical relationships right now, you may have to make due with what you can find, but shoring up these relationships is an essential way to reduce the distracting “noise” of your business. The better these 6 relationships are, the better your quality of work life.

Here they are:

- A Banker (or bankers)

- A Realtor (or realtors)

- A CPA/Accounting Firm

- A General Contractor

- An Attorney

- An Insurance Agent

Below, I list my thoughts on each of these relationships. In the future, we will explore them further, but for now, here is a brief overview of each one:

- Bankers:

- Why you need them: The ability to borrow money is great—you can leverage your cash on hand to get a better long-term return. Basically, you borrow money to do deals larger than the cash you have on hand. Real estate cash is intensive, so a good relationship with a bank is critical.

- Pay attention to: Be aware if the bank is local, regional, or national. If possible, I prefer relationships with local or regional banks. This way, I really get to know the decision-makers and can build a relationship with them. Also, be sure to know what a bank’s single borrower limit is. You need to build a relationship with a bank that is large enough to help you for a good season. You can move to a larger bank later, but going into the relationship with your eyes open from the start is a good move. A decent local bank will have a $6mm to $8mm single borrower capacity.

- Other thoughts: Having a banker you can trust is incredibly important. You don’t want to beat around the bush or be unable to talk openly and directly with your banker. You need him/her to have the ability to process things with you and help you achieve your goals. Over the years, I have had amazing relationships with several bankers that I trust completely. In our conversations, I would share all the good and bad things of a deal with them and ask their opinion. I didn’t feel like I had to put on a “mask” to go see them. Bankers see inauthenticity all the time, so I think being completely honest and transparent with them is a breath of fresh air in their world. I have often asked a banker, “What makes this a good deal for you?” Or, “What does a solid customer look like on this type of a loan product?” I also want to know what the bank looks for so I can further understand how to be a better bank customer. To learn more about the importance of a banking relationship, click here.

- Realtors:

- Why you need them: I think good realtors pay for themselves. Many deals you want will never make it to the MLS (multiple listing service). “Pocket listings,” or when realtors keep the best listings for their best customers, tend to be key in finding success in real estate. Essentially, you don’t want to compete with the entire market on every deal, and building a good relationship with a realtor is key to achieving better deals.

- Pay attention to: Make sure your realtor understands exactly what you are looking for. Don’t waste each other’s time. I usually give my realtor a list of things I want and tell him not to send me things outside those criteria.

- Other thoughts: It takes time to build a great relationship with a realtor. You need to realize that realtors have to make a living too, so leave some meat on the bone for them in a deal and don’t try to beat them out of every dollar. The more you honor their time and work, the more willing they are to bring you deals that never make it to the general public.

- CPA/Accounting Firm:

- Why you need them: Accountants will give you critical advice on how to track your activity, properly book your transactions, and manage your taxes. I firmly believe that unless you are a CPA yourself, you need a good accounting firm. Honestly, accountants will pay for themselves, so don’t be a tight wad and skimp. Find a good accountant, and he or she will make your life so much better.

- Pay attention to: Is your accountant asking good questions? Does he or she meet with you regularly and stay on top of your account? Does he or she proactively seek out information and help you plan? Does he or she add value to your business? If the answers to these questions are yes, then the accountant is worth keeping. Avoid accountants that are merely “keeping score” and not adding value to your business.

- Other thoughts: There are a variety of accountants out there. Many are so “bookish” they can’t zoom out and see the business’s big picture. Ideally, you want an accountant who understands both the big picture and the details of your business. You also want an accountant who can do reviews and taxes, which can happen in smaller firms so you don’t have to use a top 100 firm. As with other professional services, you get what you pay for.

- General Contractors:

- Why you need them: A good GC will help you repair, remodel, and build new units. You won’t be in the business for long before you need an expert on construction, so having a GC that you trust is critical. A GC can make your job more manageable and can handle lots of things that you don’t want to get into the weeds on.

- Pay attention to: Make sure you get a GC that does the following well:

- Gives you somewhat realistic estimates

- Maintains an awareness of timelines

- Retains a good base of subcontractors that enjoy working for them

- Displays good accounting and invoice reconciliation

- Communicates well

- Runs a clean job site.

- Upholds proper insurance and professional relationships

- Other thoughts: GCs are available in a wide variety. Some are very “fly by the seat of their pants,” others are very strack. Some are good communicators, others will not call you back. You need to find a GC that communicates well with you and values your project. Ask your banker or a local supply house for recommendations. The last thing you need is a GC who doesn’t pay his or her bills!

- Attorneys:

- Why you need them: You will need to set up an LLC and possibly a trust. I would not recommend trying to do it yourself online. Also, in the case you need to evict someone, attorneys come in very handy. Oftentimes, just a letter sent from an attorney can be very valuable.

- Pay attention to: Find someone that has a good reputation and is very knowledgeable. An attorney’s responsiveness and accessibility is important. A good attorney will likely be $200+ per hour. Keep in mind that sometimes the least expensive attorney is also the least productive.

- Other thoughts: Attorneys can be valuable for a plethora of reasons. As you run your business, you will have many questions come up along the way. It’s important to know an attorney well so you can access him or her when you have questions.

- Insurance Agent:

- Why you need them: If you borrow money, the bank will require you to have insurance.

- Pay attention to: It’s beneficial to use a commercial agent versus a traditional consumer agent. First, commercial agents are probably more experienced, and second, they can give you a quote from a commercial carrier rather than a standard consumer carrier.

- Other thoughts: Once I owned 5 houses, my agent told me I could apply for a commercial policy. The rates on the commercial policy were half the cost of a traditional policy. Also, my agent treated me more as a business, so I received advanced notices of rate changes and other information.

Once you have all these relationships established, I recommend grading each person on a scale of 1 to 5 on an annual basis. You need to upgrade the ones who score low, and you need to retain the ones that are already competent. I would also recommend that you keep an eye out for people who are not just “yes men,” but who are truly the best at what they do.