As Business Insider defines it, net worth is the “total value of assets you own, minus any liabilities or debts.” Building net worth has many advantages, among them opportunity, financial security, and family legacy. But what affects net worth? And how is net worth distributed among different demographics? What is one (of several) ways to grow your net worth? This article will address all of these questions, serving as a general introduction to net worth in America.

As you move through the article and evaluate your own net worth, I hope you feel encouraged to explore investment opportunities, especially homeownership and real estate.

To begin, let’s look at the first big factor of net worth: age.

Net Worth and Age:

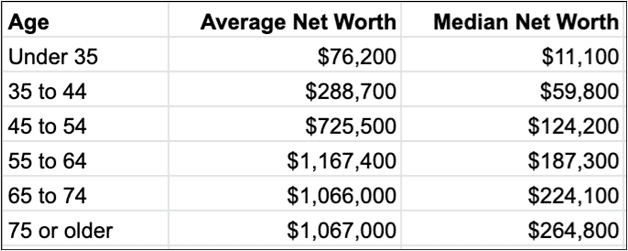

As you probably suspected, net worth generally increases with age. As individuals spend more time working, saving, and investing, their net worth tends to increase. Below is a breakdown of this trend, including both the average net worth and median net worth, which is perhaps a more accurate depiction.

Data from Federal Reserve, via Business Insider, 2016. Click here for more.

Notably, net worth experiences a massive leap between under 35 to 35-44. Again, this is to be expected as older individuals typically have larger savings and more investments than younger individuals.

Another heavy influence on net worth is education level. Let’s explore that data next.

Net Worth and Education Level:

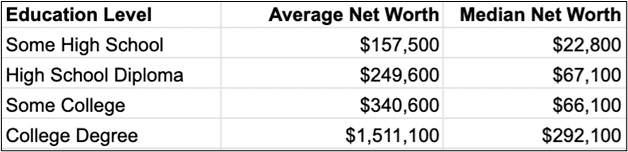

When education level increases, both the average net worth and the median net worth for Americans increase (with the exception of median net worth between individuals with a high school diploma versus individuals with some college education).

Data from Federal Reserve, via Business Insider, 2016. Click here for more.

Moving on, let’s take a look at how net worth changes with location.

Net Worth and Location:

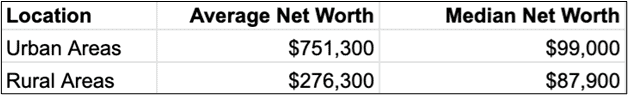

According to the article “The net worth in America by age, race, education, and location” by Business Insider, the typical American will have a higher net worth in an urban area than a typical American in a rural area, even with increasing living expenses. One reason for this, as the article points out, is the higher value of real estate in urban areas.

As indicated by the chart below, the difference in net worth between urban and rural areas is substantial, though less so when looking at the median values.

Data from Federal Reserve, via Business Insider, 2016. Click here for more.

To continue our discussion, let’s see how net worth is distributed among different racial groups.

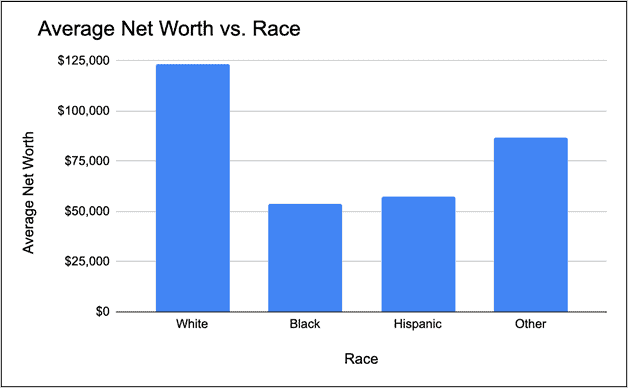

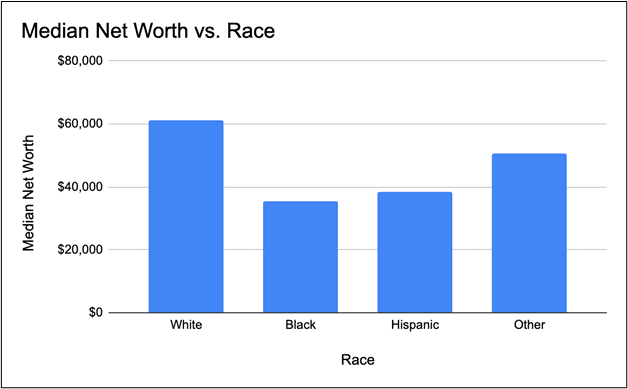

Net Worth and Race:

Based on the Federal Reserve data below, average and median net worth is highest among white Americans than any other racial group. As mentioned in the homeownership article, there are many factors behind this wealth gap, some of which (including complex societal, governmental, and personal factors) are discussed in this article by the Federal Reserve: Disparities in Wealth by Race and Ethnicity in the 2019 Survey of Consumer Finances.

Data from Federal Reserve, via Business Insider, 2016. Click here for more.

Data from Federal Reserve, via Business Insider, 2016. Click here for more.

Gaps in wealth are made evident through the two visuals above. If you want to learn more about the wealth gap (particularly between white and Black Americans), I would encourage you to check out another article by Business Insider: Americans grossly underestimate the racial wealth gap between Black and white families — and it’s making it harder to achieve financial equality.

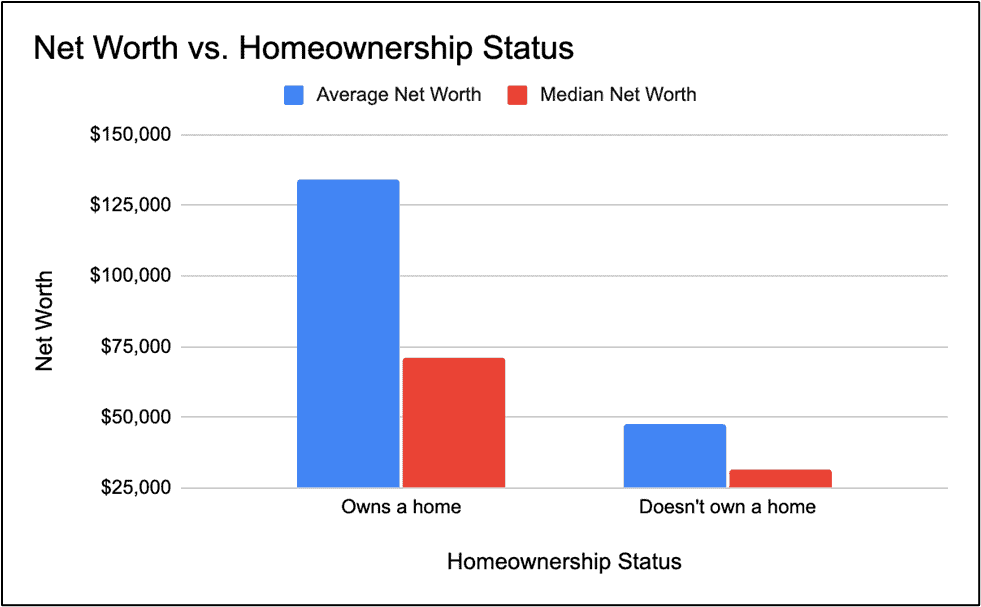

Before we move onto areas where net worth can be improved, let’s look at one more influencing factor: homeownership.

Net Worth and Homeownership:

As briefly mentioned in a previous article about homeownership in America, homeownership has a significant impact on an individual’s net worth. The graph below displays this impact, both on average and median net worth.

Data from Federal Reserve, via Business Insider, 2016. Click here for more.

Based on the above data, the typical homeowner has an average net worth that is 2.8 times the net worth of those that don’t own a home and a median net worth that is 2.3 times the net worth of those that don’t have a home.

While owning a home isn’t a possibility for everyone (as mentioned in a previous article), it is an advantageous strategy when looking to increase your net worth. Let’s talk about that next.

Growing Net Worth:

As we saw above, the average net worth of homeowners is about $100,000 higher than those who don’t own a home. In this line of reasoning, for every home added, an additional $100,000 is added to an individual’s net worth ($100,000/per house). Here we enter a discussion of real estate investing, particularly in the rental property industry.

According to a study conducted by TransUnion, 31% of the average landlord’s income comes directly from rental property revenue, see here for more. Furthermore, the article 21 Insightful Landlord Statistics 2020 states that a landlord’s median household income is $97,000 per year versus the national median household income of $62,000.

Generally speaking, a higher income results in a higher net worth, and with a higher net worth, there is typically more financial opportunity, security, and influence. If you are looking for ways to increase your choices in life, I would urge you to investigate the possibility of entering the rental property industry. In another article, I explain what the typical American landlord looks like, which may open your eyes to your own potential in increasing your net worth.

In Summary:

- Net worth generally increases with age and education level.

- Net worth is higher in urban areas than rural areas, and white Americans hold the highest net worth among all other racial groups.

- Homeowners have a significantly higher net worth than those who don’t own homes, and homeownership and/or investing in rental properties are two of several good ways to increase net worth.