It can be argued that (historically) a pinnacle of the American Dream is homeownership. The ability to own the home you live in has been an attraction to many people throughout American history, though there are some factors that influence one’s ability to own a home.

This article will explore several (not all) of these influencing factors and how each one affects homeownership rates. By the end, a question will be posed: is homeownership attainable? If so, is it worth it?

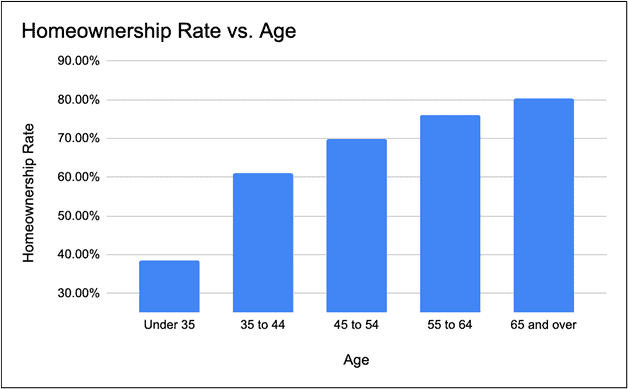

Before I begin my discussion, it’s important for you to know that the national average homeownership rate in America is 65.8% (as of 2020). Now that you have a baseline in mind, let’s look at our first influencing factor: age.

Homeownership and Age:

As age increases, so does homeownership rate. While this rate increases at a relatively steady pace, a notable jump is seen between individuals under the age of 35 to individuals between 35 to 44 years old (from 38.5% to 61%).

Data from Statista, 2020. Click here for more.

According to Statista, this trend can be explained by a general lack of savings within younger generations as compared to older generations, who typically have had more time to work and save money.

Student debt is also a barrier for many younger generations when it comes to saving up for a house. To learn more about this issue, see another study by Statista: Student debt effect on first-time home buyers US 2019.

When discussing student debt, it’s important to also consider the influence education level has on homeownership rates. Let’s move onto the next section and examine this further.

Homeownership and Education Level:

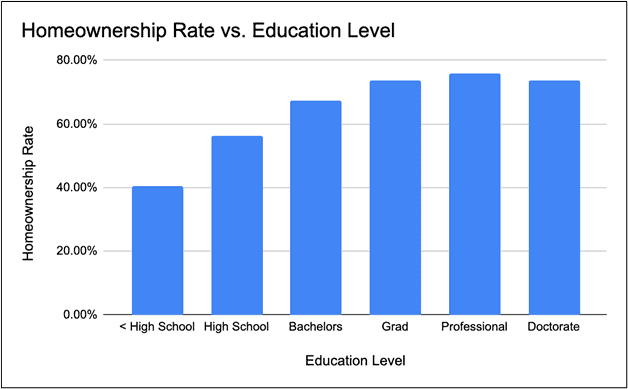

When looking at the relationship between homeownership rates and education level, it’s typical to find that as education level increases so does homeownership rate (with the exception of a doctoral degree).

Data from Trulia, 2015. Click here for more.

The steepest jumps in homeownership rates are between those who have completed high school (56.4% homeownership rate) compared to those who have not (40.5% homeownership rate). The jump between high school and college completion is significant as well (56.4% to 67.3%).

According to Trulia, the largest explanation for this trend is that as education levels increase, so do income levels (with the exception of a doctoral degree, again). Thus, the more income an individual earns, the more likely he or she is able to own a home. Let’s take a closer look at income vs. homeownership rate in the next section.

Homeownership and Income Level:

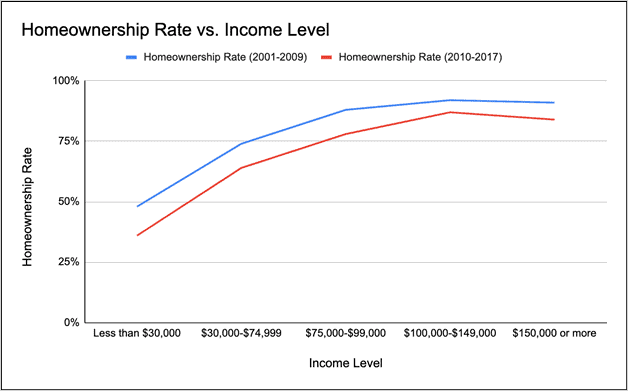

As briefly mentioned above, as income level increases, homeownership rate generally increases (not including $150,000 or more).

Data from Statista, 2020. Click here for more.

As you can see in the chart, there is a decent decrease in homeownership levels from 2001-2009 to 2010-2017 in all income categories. An educated guess would point to the economic recession, though there are probably additional factors at work here. Let’s take a look at the region factor next.

Homeownership and Region:

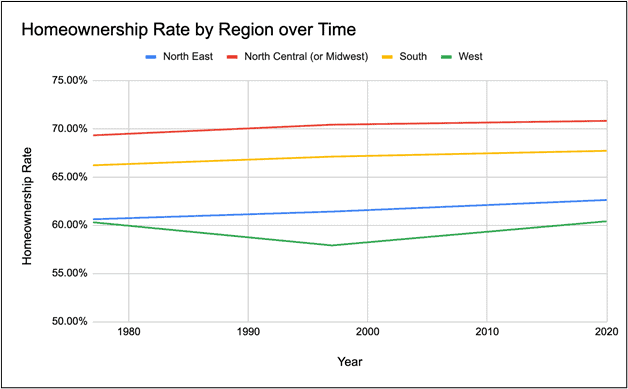

Homeownership levels are also influenced by region. In general, the South and the Midwest have higher homeownership levels than the West and the Northeast.

Data from ResearchGate, 1998 (click here) and US Census Bureau, 2020 (click here)

Christopher Mazur, survey statistician for Census Bureau, explains that rural and urban areas also have staggering differences in homeownership rates. Across the United States, the rural homeownership rate is 81.1%, while the urban homeownership rate is only 59.8%. Mazur also explains that this pattern holds in all four regions. To read more from Mazur, check out this article: Homeownership Higher in Rural Areas.

To break down our discussion even more, let’s look at homeownership vs. race.

Homeownership and Race:

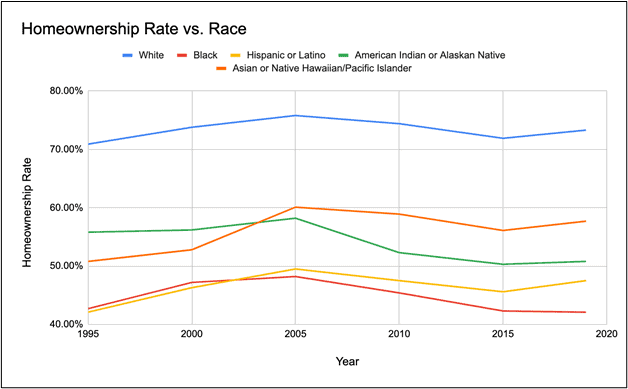

As made evident by the graph below, homeownership rates among white Americans are much higher than any other racial group. From 1995-2020, this trend has remained true, while other racial groups have overlapped during certain years.

Data from USAFacts, 2020. Click here for more.

The steepest difference in homeownership rates and race is between white and Black Americans. In 2019, for example, the average homeownership rate for white Americans was 73.3%, while the average homeownership rate for Black Americans was 42.1% (US homeownership rates by race).

There are many systemic and historical factors behind this inequality, many of which deserve ample discussion elsewhere, but a large one, according to USAFacts, is wealth disparity. Simply put, white people own 86% of the nation’s wealth, yet only make up 60% of the population. To read more on this issue, check out another USAFacts article here.

So, how does all of this data affect you? Let’s talk about that next.

What Does This Mean for You?

Depending on your position in life, you may be more influenced by some factors listed above than others. In any case, I would encourage you to at least explore the possibility of owning your own home. While it’s not a viable option for everyone, there are some significant benefits to homeownership, including the way it affects net worth (the average net worth of a homeowner in America is almost $100,000 higher than a non-homeowner). The influence of homeownership on net worth can affect many other aspects of life, including opportunity, financial security, and family legacy, many of which are discussed in other articles on this blog.

In Summary:

- Generally, American homeownership rates increase with age, education level, and income level.

- Homeownership rates are highest in the Midwest, followed closely by the South. In every region, homeownership rates are higher in rural areas than urban.

- White Americans have the highest homeownership rate than any other racial group. There are many factors behind this gap, but they will be discussed elsewhere.

- Regardless of your position in life, it can be worthwhile to at least explore the option of owning your own home.

- Perhaps the largest benefit of homeownership is the increase in net worth ($100,000), which impacts not only the individual homeowner, but their beneficiaries as well.