In a previous article, I discussed the average rental property owner in America. For this article, I will zoom out a bit to discuss a macro view of all rental property owners in America, and then I will move into a narrower discussion of what this data could mean for you. My discussion will be based on some findings from the 2015 U.S. Bureau’s Rental Housing Finance Survey. Hyojing Lee, a former Postdoctoral Fellow at the Joint Center for Housing Studies of Harvard University, arranges these findings in some helpful tables, which I have included below. To see Lee’s article in full, click here. For a general overview, see the content below.

Who Owns Rental Properties by Units in Structure?

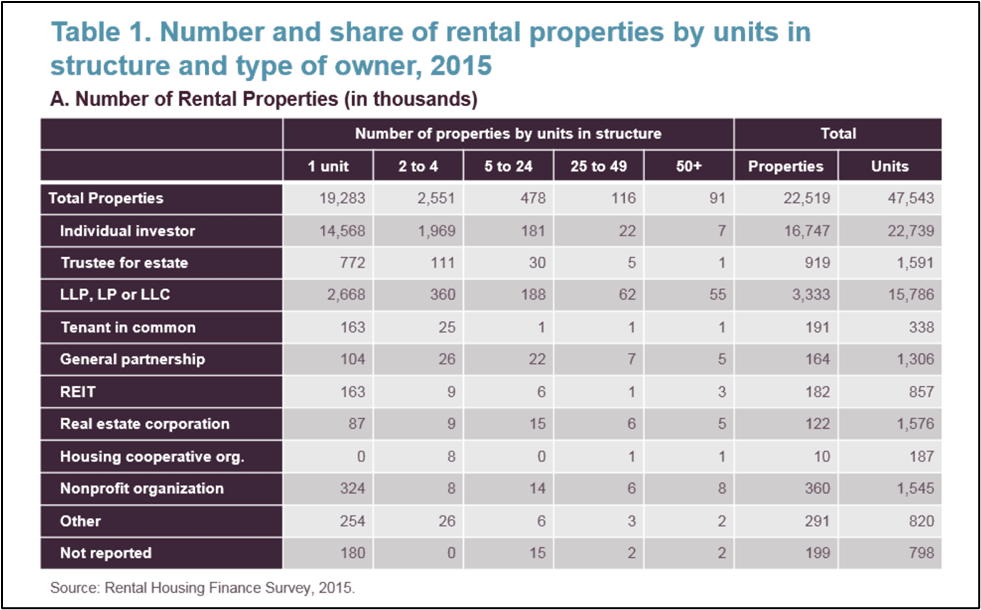

A notable set of data presented by Lee (see table below, from the Joint Center for Housing Studies of Harvard University) depicts the number (in thousands) of rental properties by units in structure and type of owner for the United States circa 2015. As you can see, individual investors own the largest share of rental properties (16.7 million) in America, followed by LLP, LP or LLCs, which own 3.3 million rental properties.

Significantly, as the number of units in structure (or size of property) increases, the number of properties owned by individual investors decreases. For example, individual investors own 14.5 million properties containing one unit (75.5%), but only 7,000 properties containing 50+ units (7.7%). Of course, this trend can probably be explained by the fact that individual investors typically have less financial power and ability than an LLP, LP or LLC, which together hold 50,000 properties containing 50+ units (the largest number out of every type of owner at 60.4%).

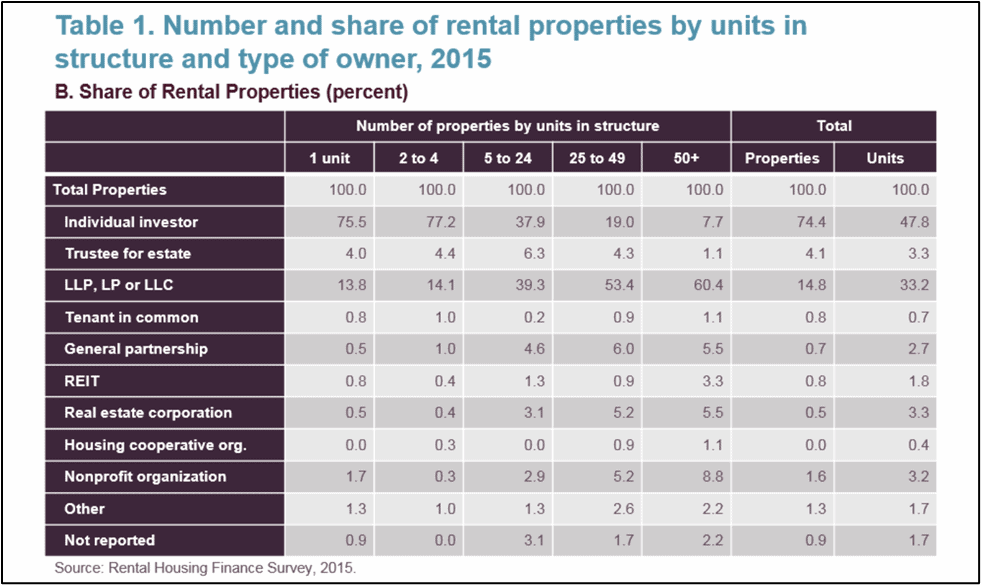

The next table of data (still from the Joint Center for Housing Studies of Harvard University) looks at the same variables as the table above, only this time, it evaluates each type of property owner by the share of rental properties rather than the number owned.

The table above provides a quick look at every share in rental properties. Here, we can look at individual investors as owning 74.4% of rental properties in America, yet only 47.8% of all units. As explained above, this trend can probably be explained by the lack of financial resources for individual investors when compared to other types of owners who own properties with more than 1 unit.

Take some time to investigate the two tables above. You may be surprised by how much influence and ownership each owner type has. Again, if you want to read about Lee’s interpretations, check out his article: Who Owns Rental Properties, and is it Changing?.

Once you’ve mulled over the charts, it may be helpful to learn about what this data could mean for you. Let’s discuss this next.

What Type of Owner Are You?

It may be that you are interested in the rental property industry, but you are unsure of where to begin. Or perhaps you have already started on your rental property journey and are slowly building your portfolio. Maybe you have years of experience working with rental properties and you are here because the data interests you. Whatever stage you find yourself in, I think it can be helpful to find what type of owner you identify with in the data above. For the sake of our discussion, we will focus on the “individual investor” and “LLP, LP or LLC” categories, which many of you are likely to identify with.

Individual Investors:

First, let’s pose a question. Have you ever thought about whether or not you can own a rental property by yourself? Well, the data above would say you can. Out of all rental properties in the nation, individual investors own 74.4% of them. This means that individuals hold a lot of power and influence in the rental property industry, and they are needed! For example, if there are 128 million households in the U.S. and the national homeownership rate is 65.8% (according to the U.S. Census Bureau), then we can infer that 84 million households own homes, while the remaining 44 million households are likely to rent. So, if 44 million households are looking to rent, who are they most likely to rent from? Again, the data would point to individual investors since they are the overwhelming majority of rental property owners.

Furthermore, when it comes to one-unit properties, or single family residences, individual investors hold the greatest share at 75.5%. Why is this significant? Well, out of the 44 million households renting in America, it’s a fair guess that many of them would find a single family residence appealing. The benefits of such a residence are numerous, including increased privacy, comfort, and freedom. So, if single family residences make up 40% of all rental properties and individual investors own 75.5% of them, we can infer that the properties that individual investors own are in high demand and are a very critical part of the rental market. The best part? You can join them! As we saw in a previous article, TransUnion reports that the average landlord owns 3 properties, so again, we see that small, individual investors have a hefty impact on the rental property industry.

If you don’t identify as an individual investor, you may find more in common with the LLP, LP or LLC category. Let’s explore that next.

LLP, LP or LLC Owners:

Limited Liability Partnerships (LLPs), Limited Partnerships (LPs), and Limited Liability Companies (LLCs) are another category of interest. As the number of units in a property increases, so does the number of properties owned by this category. For example, while this category only owns 13.8% of single-unit properties, they own 60.4% of properties with 50 units or more.

For the LLPs, LPs, and LLCs that own single-unit properties, it’s not outlandish to guess that many of these companies are owned by individuals or families. These are most likely investors who are wisely protecting themselves and their assets from direct, personal risk. As the number of units in a property increases (especially in the jump from 2-4 properties to 5-24 properties), it’s likely that the LLPs, LPs, and LLCs are transitioning from single or small partnerships to larger partnerships with more investors. This approach continues to disperse risk as scale increases, which is a smart way to acquire more rental properties. As you can see from the data, for rental properties that contain 5 or more units, LLPs, LPs, and LLCs hold the majority share (39.3% of properties with 5-24 units, 53.4% of properties with 25-49 units, and 60.4% of properties with 50+ units).

In a future article, we will discuss the formation of LLCs and related companies and when such a formation becomes necessary or appealing to an individual investor in real estate. For now, it can be helpful to recognize that LLPs, LPs, and LLCs have a general appeal because they have a flexible ownership structure (different classes of stock, accommodations for groups of people buying together) and can help you limit your personal risk.

Conclusion:

Based on the tables and discussion above, it is clear that individual investors have the greatest influence on and share of rental properties, especially those that are single family residences. As the scale of a rental property increases, LLPs, LPs, and LLCs tend to take on a greater share of rental properties, especially those properties that contain 5 or more units. Many LLPs, LPs, and LLCs are likely owned by individuals or families, especially before they reach a larger scale. Between this assumption and the data supporting individual investors, it’s easy to see that individuals are currently driving and sustaining America’s rental property industry. If you haven’t yet entered the industry, the data supports that you can! It’s everyday individuals who contribute the most to this market. If you want to read some stories about real individual investors, check out the “Real People” section of this blog.

In Summary:

- Individual investors own the majority of the nation’s rental properties (74.4%) and 75.5% of single-unit properties, which are typically very appealing to families.

- LLP, LP or LLC owners own 60.4% of properties containing 50 or more units.

- Individuals (including individuals who own LLPs, LPs, and LLCs) hold an incredible amount of influence and power in the real estate industry. With an estimated 44 million American households who rent, the individual has the potential to provide adequate, appealing housing.

- As an individual, you have the ability to join the real estate industry in a significant way. It is normal, everyday folks who keep the industry running. You could be a part of it!